Revolut

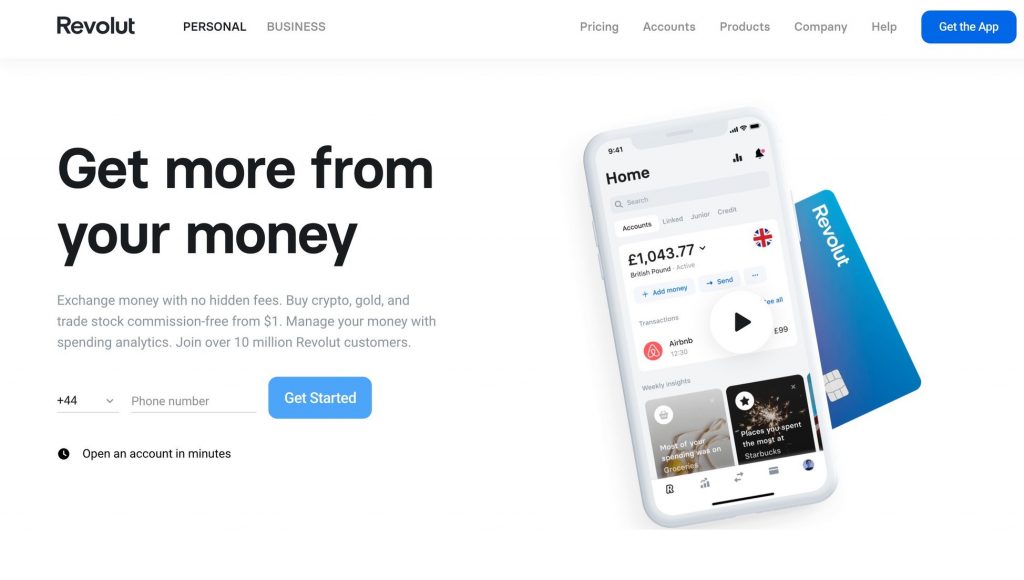

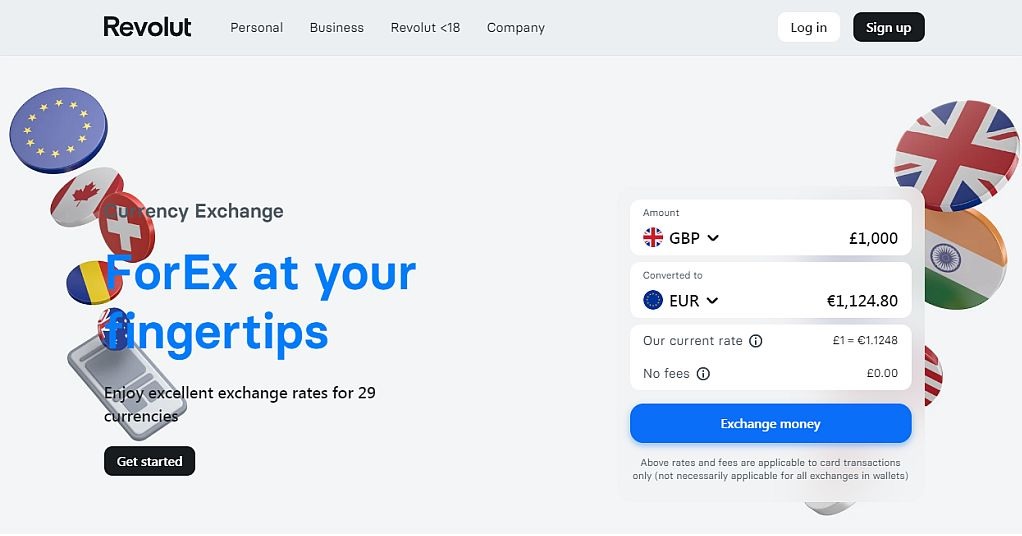

Revolut is a digital banking and financial services company based in the United Kingdom. The company offers a range of services including currency exchange, money transfers, and debit cards to its customers through a mobile app and website. One of the key features of Revolut is its ability to allow customers to hold and exchange multiple currencies at competitive exchange rates. Revolut also offers a range of other financial services, including cryptocurrency trading, insurance, and savings accounts.

Revolut Overview

Revolut is a digital banking and financial services company that provides a range of services to its customers through its mobile app and website. The company was founded in 2015 by Nikolay Storonsky and Vlad Yatsenko and is based in the United Kingdom. One of the key features of Revolut is its ability to offer multi-currency accounts to its customers, allowing them to hold and exchange multiple currencies at competitive exchange rates . Revolut also provides customers with a physical or virtual debit card that they can use to make purchases and withdraw cash at ATMs around the world.

In addition to its currency exchange and debit card services, Revolut offers a range of other financial services, including cryptocurrency trading, insurance, and savings accounts. Customers can also use the Revolut app to track their spending and manage their finances, set budgets and savings goals, and receive real-time notifications on their transactions.

How To Use Revolut

Here are the basic steps to using Revolut:

- Download the Revolut app: Revolut is a mobile app-based service, so the first step is to download the app on your smartphone or tablet. It’s available for free on both the App Store and Google Play.

- Sign up for an account: To sign up, you will need to provide some basic personal information, such as your name, email address, and phone number. You will also need to create a username and password.

- Verify your identity: Revolut is a regulated financial institution, so you will need to verify your identity before you can start using the service. You can do this by providing a government-issued ID and taking a selfie within the app.

- Add money to your account: Once your account is verified, you can add money to your account using a debit card or bank transfer. Revolut offers a range of currencies, so you can choose to add funds in your preferred currency.

- Use your Revolut account: With funds in your account, you can start using Revolut for a range of services, such as making payments, transferring money to other Revolut users, and exchanging currencies. You can also order a physical or virtual debit card, which you can use to make purchases and withdraw cash at ATMs.

- Monitor your spending and manage your finances: Revolut offers a range of features to help you manage your finances, such as real-time notifications, budgeting tools, and savings goals. You can track your spending, set limits on your card, and lock and unlock your card if it’s lost or stolen.

Revolut is straightforward and user-friendly. The app offers a range of features that can help you save money on fees and make managing your finances easier.

Revolut Customer Service

Revolut offers customer support through its in-app chat feature, which is available. To access customer support, you can simply open the app and click on the “Support” tab in the menu. From there, you can type in your question or issue and a Revolut agent will respond to you as soon as possible.

Revolut also provides a comprehensive FAQ section on its website, which covers a wide range of topics related to the service. If you prefer to speak with a customer support agent over the phone, you can request a callback through the app, and a Revolut agent will call you back at a convenient time.

Benefits, Features And Advantages Of Revolut

Here are some of the key benefits, features, and advantages of using Revolut:

- Multi-currency accounts: Revolut allows you to hold and exchange multiple currencies at competitive exchange rates, making it a convenient option for people who frequently travel or send money abroad.

- Real-time notifications: Revolut sends real-time notifications for every transaction made through the app, which can help you stay on top of your spending and detect any unauthorized transactions.

- Budgeting tools: Revolut offers budgeting tools, including the ability to set spending limits and savings goals, which can help you manage your finances more effectively.

- Security features: Revolut uses a range of security features to protect your account, including two-factor authentication, biometric login, and the ability to lock and unlock your card through the app.

- Insurance: Revolut offers a range of insurance options, including travel insurance, device insurance, and personal accident insurance.

- Savings accounts: Revolut offers savings accounts with competitive interest rates, allowing you to earn interest on your savings.

Revolut offers a range of features and benefits that can help you save money on fees, manage your finances more effectively, and access a range of financial services all in one place.

Experts Of Revolut

- Revolut offers low-cost international money transfers and currency exchange.

- It provides a mobile app that allows users to manage their finances, including budgeting and spending tracking.

- Revolut offers travel insurance and airport lounge access to premium customers.

- The company has a user-friendly interface that simplifies the financial management experience for its users.

Revolut Conclusion

Revolut is a digital banking and financial services company that provides a range of services through its mobile app and website. Revolut offers a range of features and benefits, including multi-currency accounts, transparent pricing, real-time notifications, budgeting tools, cryptocurrency trading, and insurance options. The app is user-friendly and offers excellent customer support through its in-app chat feature.

Overall, Revolut can be a convenient and cost-effective option for people who frequently travel or send money abroad, or for those looking to manage their finances more effectively.