Borrowell is a software company that focuses on eliminating the need for borrowers to visit a bank or other financial institution. The company’s platform allows borrowers to borrow money from friends and family, as well as via online loans. Borrowell was founded in 2014 by CEO and co-founder Rohan Jayaraman.

Borrowell is a great way to get approved for a credit card, mortgage, or other loan. This online lender offers a variety of products, so you can find the one that’s right for you. Borrowell also offers a fast and easy application process, so you can get started getting the money you need as soon as possible.

History of Borrowell Bank

Borrowell Bank is a financial institution that helps thousands of Canadians access loans that suit their financial profile. The company was founded in 1919 and has since become one of the largest providers of personal loans in Canada. Borrowell offers a variety of loan products, including short-term, long-term, and variable-rate loans. The bank also offers a variety of loan options for borrowers, including direct lenders and brokers. Borrowell Bank is headquartered in Toronto and operates across Canada.

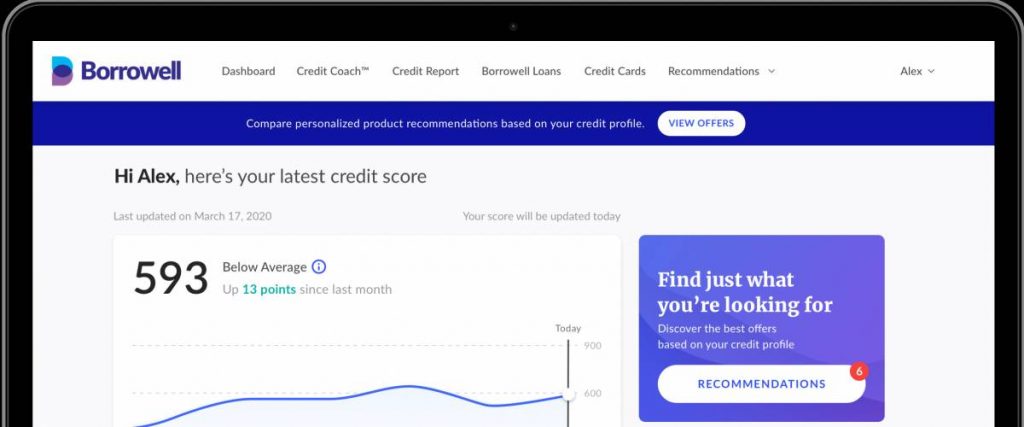

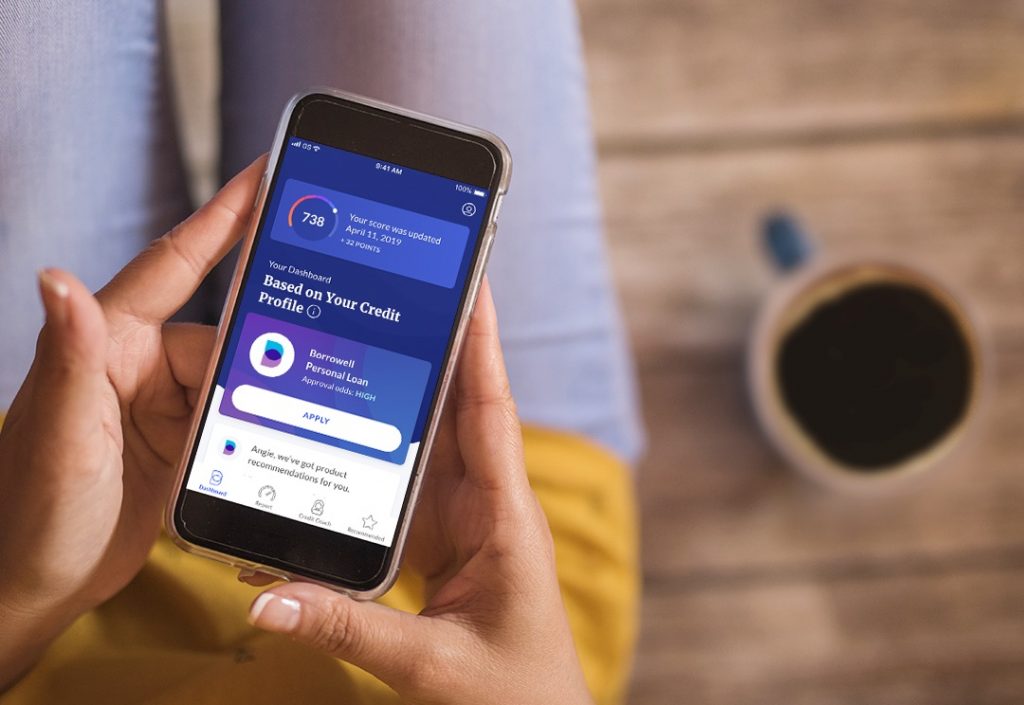

How does Borrowell work?

Borrowell is a Canadian online lender that helps thousands of Canadians access loans that suit their financial profile. Borrowell offers a variety of loans, including short-term, long-term, and auto loans. Unlike traditional lenders, which require a down payment and credit score, Borrowell allows borrowers to borrow up to 95% of the value of the car.

Borrowell Present Situation

Borrowell is a Canadian financial institution that helps thousands of Canadians easily access loans that suit their financial profile. This is especially important for people who may not have access to traditional banking services or who have difficulty getting approved for loans from other institutions. Borrowell offers loans in a wide range of categories, including personal, small business, and real estate. With over $2 billion in assets under management, Borrowell is one of the largest providers of loans in Canada.

Borrowell Results

Borrowell is a Canadian company that helps thousands of Canadians easily access loans that suit their financial profile. Borrowell offers online loans in a variety of currencies and loan amounts, making it one of the most convenient and accessible sources of credit for Canadians.

Borrowell has helped countless Canadians get the financing they need to start or expand their businesses, buy their first home, cover unexpected expenses, and more.

Credit cards can be an incredibly beneficial financial tool, if used responsibly. We will discuss how borrowing money with a credit card can help you achieve your financial goals, as well as some key things to keep in mind when using a credit card. Finally, we’ll provide some recent results from our analysis of various types of loans and credits.

Borrowell Prospects For The Future

Borrowell is a Canadian company that helps thousands of Canadians easily access loans that suit their financial profile. Borrowell is looking to continuegrowing its lending portfolio and has announced a number of new partnerships in the past few months. These partnerships include Loans4Life, which provides short-term credit products to Canadians in need, and True North Financial, a lender specializing in high-net worth individuals and businesses.

Tips for Borrowelling Safely, Using Credit Cards

A few dollars saved can add up to a lot over the course of a year. Here are some tips for safe borrowing when using your credit card:

1. Always have your credit card with you when you go shopping.

2. Don’t exceed your credit limit.

3. Pay your bills on time.

4. Use your credit card for emergencies only.

Borrowell Services

Borrowell is a Canadian company that helps thousands of people access loans that fit their financial profile. The company has a wide range of loan products that can help borrowers finance their dreams, such as car loans, mortgages, and student loans. Borrowell is easy to use and provides fast, reliable service. Whether you are looking for a short-term loan or a long-term loan, Borrowell can help you get the loan you need.

The Benefits Of Using Borrowell

Borrowell is a great resource for Canadians who need easy access to loans that suit their financial profile. With Borrowell, borrowers can easily find and apply for loans from top lenders. The benefits of using Borrowell include speed and convenience, as well as the assurance that loans are tailored to your needs.

Borrowell Features, Advantages, Benefits

Borrowell Insurance is a subsidiary of the Borrowell Group, which was founded in 1892. The company provides insurance products and services to consumers and small businesses in the United Kingdom. Its products include car, home, travel, and health insurance. Borrowell Insurance offers a variety of benefits, including discounts on premiums for customers who use its card scheme, roadside assistance, and a warranty on all products. The company has a reputation for providing high-quality products at competitive prices.

Borrowell is a based online insurance company that offers a range of insurance products such as home insurance, pet insurance, and car insurance. The company offers a variety of benefits such as fast, easy, and secure online access to policy information and 24/7 customer support. Borrowell’s products are designed to help customers save money on their insurance premiums while providing coverage that is tailored to their needs. The company’s commitment to providing quality products and outstanding customer service makes it one of the most popular online insurers .

Borrowell Pros And Cons

Pros:

- Borrowell Insurance offers affordable rates.

- Bank loan options are available.

- Easy to apply for.

- Borrowell Insurance can help keep you and your family safe if something happens while you’re out of town.

Cons:

- May require a credit check.

- Can take some time to receive approval.

- Borrowell Insurance may not be enough coverage if a disaster strikes.

- A bank loan can lead to high interest rates and other costs, such as fees.

Borrowell Conclusion

Borrowell is a Canadian newcomer to the market that has quickly become one of the most popular and user-friendly options for accessing loans. The company has helped thousands of Canadians access loans that suit their financial profile, making it an incredibly valuable resource for those in need.

whether you are considering borrowing money to invest, or insuring your money so that it can grow tax-free, it’s important to be informed and work with a qualified professional.