Kovo

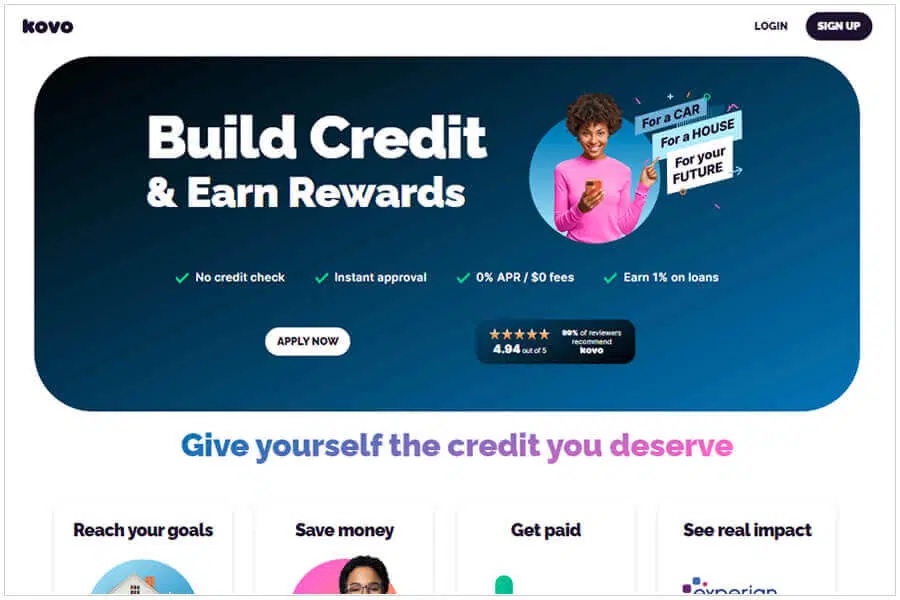

Kovo is a service that aims to help individuals build their credit scores across all four major credit bureaus: Equifax, Experian, TransUnion, and Innovis. By using the Kovo service, individuals can take steps to establish and improve their credit history, which can be beneficial when applying for loans, credit cards, or other financial products.

What Is Kovo?

Kovo is a service that aims to help individuals build their credit scores across all four major credit bureaus: Equifax, Experian, TransUnion, and Innovis. By using the Kovo service, individuals can take steps to establish and improve their credit history, which can be beneficial when applying for loans, credit cards, or other financial products. Kovo is a revolutionary service that helps individuals build their credit scores across all four major credit bureaus: Equifax, Experian, TransUnion, and Inn. Kovo allows users to manage and optimize their credit score by providing them with personalized insights into how they can best improve their ability to financially achieve long-term goals. It offers users a unique scoring system that provides an accurate snapshot of an individual’s financial health as well as the ability to pay bills in order to help better maintain the user’s financial wellbeing. Kovo also provides 24/7 customer support for any questions or issues users may have in order to make sure they are comfortable managing their money. With Kovo, individuals can track and measure progress towards building a strong credit score.

How To Use Kovo

Use Kovo:

- Sign up: Visit the Kovo website and create an account. You may need to provide some personal information, such as your name, contact details, and social security number.

- Connect your accounts: Once you have an account, you will likely be prompted to connect your existing bank account or debit card to the Kovo service. This connection allows Kovo to track your payment activities.

- Make payments: After linking your account, you can start making payments through the Kovo platform. These payments may include bills, expenses, or subscriptions. Kovo will report these payments to the credit bureaus on your behalf.

- Monitor your progress: Over time, you should monitor your credit reports from the credit bureaus to ensure that the reported payments are accurately reflected in your credit history. This will help you track your progress and identify any discrepancies or errors.

- Earn rewards: Some credit-building services, including Kovo, offer rewards or incentives for using their platform. These rewards may come in the form of points or cashback that can be redeemed for various benefits, such as gift cards or discounts.

Kovo Customer Services

here are some potential services that Kovo may offer:

- Credit Reporting: Kovo may report your payments to the credit bureaus, such as Equifax, Experian, TransUnion, and Innovis, to help you build a positive credit history across all four bureaus.

- Payment Tracking: The service may track your payments made through their platform, ensuring they are reported accurately to the credit bureaus.

- Credit Education: Kovo might provide educational resources and guidance to help you understand credit-building strategies, improve your credit score, and make informed financial decisions.

- Rewards Program: Some credit-building services offer rewards or incentives for using their platform responsibly. This could include earning points, cashback, or other rewards that can be redeemed for various benefits.

- Credit Monitoring: Kovo might provide tools or services to monitor your credit reports and scores, allowing you to stay updated on any changes or potential issues.

- Personalized Recommendations: The service might offer personalized recommendations based on your credit profile, suggesting actions you can take to improve your creditworthiness and overall financial health.

Benefits, Features And Advantages Of Kovo

Here are some common benefits and features of Kovo:

- Credit Building: One of the primary benefits of using a credit-building service like Kovo is the opportunity to establish and improve your credit history. By making timely payments and demonstrating responsible financial behavior, you can work towards building a positive credit profile.

- Multiple Credit Bureau Reporting: Kovo may report your payments to all four major credit bureaus—Equifax, Experian, TransUnion, and Innovis. This broad reporting can help ensure that your credit-building efforts are reflected across multiple credit reports.

- Convenience and Automation: Credit-building services often provide a streamlined and automated process for tracking and reporting your payments. This can make it easier to establish a positive payment history without the need for manual tracking or intervention.

- Rewards and Incentives: Some credit-building services offer rewards or incentives for using their platform responsibly. These rewards may come in the form of points, cashback, or discounts that can provide additional value or motivation to engage in credit-building activities.

- Credit Education and Resources: Kovo may provide educational resources and tools to help you understand credit, improve your financial literacy, and make informed decisions. These resources can empower you to develop healthy financial habits and maintain a strong credit profile.

- Credit Monitoring: The service might offer credit monitoring features, allowing you to stay updated on changes in your credit reports and scores. This can help you identify any potential errors, discrepancies, or signs of identity theft.

Experts Of Kovo

- Kovo offers a free credit monitoring service, allowing users to stay on top of their credit score and report.

- The platform provides personalized recommendations for actions that can improve credit scores.

- Users can link all four major credit bureaus to Kovo, giving a comprehensive view of their credit history.

- Kovo’s mobile app allows for easy access and management of credit information on-the-go.

- Kovo offers educational resources and tips on how to build and maintain good credit.

Kovo Conclusion

In conclusion, Kovo is a service that aims to help individuals build their credit scores across multiple credit bureaus. Kovo service, individuals can take steps to establish and improve their credit history, which can be beneficial when applying for loans, credit cards, or other financial products. Kovo is a revolutionary service that helps individuals build their credit scores across all four major credit bureaus: Equifax, Experian, TransUnion, and Inn. Kovo allows users to manage and optimize their credit score by providing them with personalized insights into how they can best improve their ability to financially achieve long-term goals. It offers users a unique scoring system that provides an accurate snapshot of an individual’s financial health as well as the ability to pay bills in order to help better maintain the user’s financial wellbeing. Kovo also provides 24/7 customer support for any questions or issues users may have in order to make sure they are comfortable managing their money.