Novo

Novo, an online business banking solution. It offers a range of features and tools designed to simplify banking and financial management for business owners.

What Is Novo?

Novo is an online business banking platform that provides banking services tailored specifically for small businesses. It offers a range of features and tools designed to simplify banking and financial management for business owners. Novo aims to provide a modern and user-friendly banking experience, focusing on efficiency, convenience, and integration with other business tools. Novo allows businesses to open and manage business checking accounts entirely online. Novo integrates with popular accounting software like QuickBooks, making it easier for businesses to manage their finances and reconcile transactions. Novo provides customer support to assist business owners with any inquiries or issues they may have.

How To Use Novo

To use Novo, you’ll need to follow these general steps:

- Sign up: Visit Novo’s official website and click on the “Sign Up” or “Get Started” button. You will be prompted to provide necessary information, such as your business details and personal information.

- Verification: After submitting your information, Novo may require you to verify your identity and provide any additional documentation they may need. This could include submitting your business license, identification documents, or other relevant paperwork.

- Account Setup: Once your identity and business details are verified, you can proceed with setting up your Novo account. This typically involves creating a username and password to access your account securely.

- Fund Your Account: To start using Novo for your business banking needs, you’ll need to fund your account. You can transfer funds from an existing bank account or deposit funds using the available options provided by Novo.

- Explore Features: Once your account is set up and funded, you can start exploring the features and services offered by Novo. This may include managing your transactions, tracking expenses, integrating with accounting software, and accessing other banking tools and resources.

- Utilize Mobile App: Novo usually provides a mobile app for easy access to your business accounts on the go. Download the Novo mobile app from the respective app store and log in using your account credentials to manage your finances from your mobile device.

- Contact Customer Support: If you encounter any issues or have questions about specific features, it’s recommended to reach out to Novo’s customer support. They can provide assistance and guidance to help you make the most of their platform.

Novo Customer Services

Novo offers a range of services and features tailored to meet the banking needs of small businesses. Here are some of the key services provided by Novo:

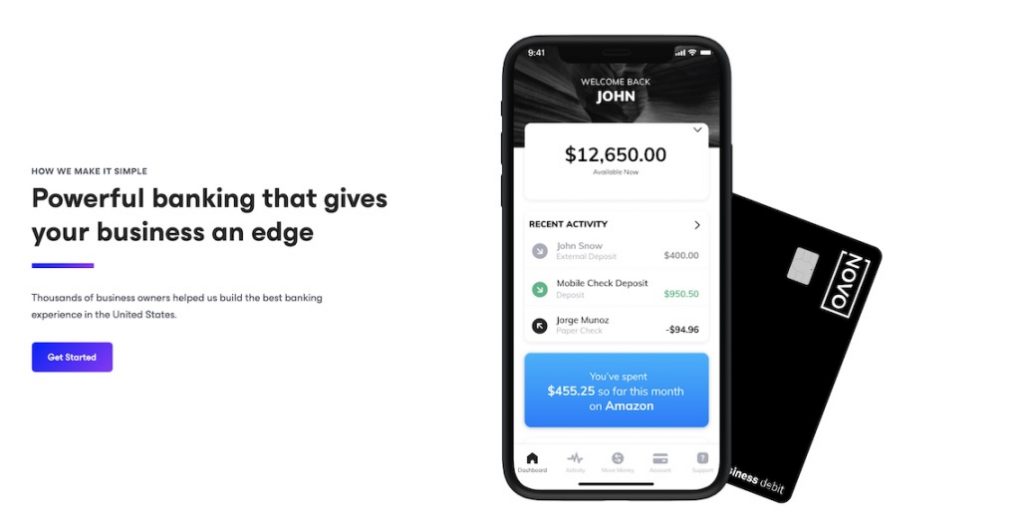

- Business Checking Account: Novo allows businesses to open and manage a business checking account entirely online. This account comes with features such as unlimited transactions, online banking, and mobile banking access.

- Business Debit Card: Novo provides a business debit card that is linked to your business checking account. This card can be used for business expenses, and transactions made with the card are reflected in real-time in your Novo account.

- Mobile Banking: Novo offers a mobile app that enables you to access your business accounts, make mobile deposits, view transaction history, and manage your finances on the go.

- Integration with Accounting Software: Novo integrates with popular accounting software platforms like QuickBooks, making it easier to manage your financial data and reconcile transactions.

- Instant Money Transfers: With Novo, you can send and receive money instantly between Novo accounts. This feature allows for quick and convenient money transfers, making it easier to manage your cash flow.

- Customer Support: Novo has a dedicated customer support team that is available to assist you with any inquiries or issues you may have. You can contact their support team via email, phone, or through their website.

Benefits, Features And Advantages Of Novo

Novo offers several benefits, features, and advantages for small businesses. Here are some key aspects:

- Online Convenience: Novo is an online business banking solution, allowing you to manage your business finances conveniently from anywhere, at any time. You can access your accounts, make transactions, and track your financials through their user-friendly online platform or mobile app.

- Streamlined Account Setup: Novo simplifies the account setup process for business owners. You can sign up online, provide the necessary documentation, and get your business checking account up and running without the need for lengthy paperwork or visits to a physical bank branch.

- Business-Focused Features: Novo provides features tailored specifically for small businesses. This includes integrations with accounting software like QuickBooks, enabling seamless synchronization of your financial data. The platform also offers expense categorization, financial reporting, and other tools designed to help you manage your business finances more efficiently.

- Fast and Instant Transfers: Novo allows for quick money transfers between Novo accounts, providing instant availability of funds and facilitating efficient cash flow management for your business.

- Focus on Small Businesses: Novo specifically caters to the needs of small businesses, understanding their unique requirements and challenges. The platform is designed to provide a user-friendly, modern banking experience that aligns with the needs of small business owners.

Experts Of Novo

- Novo offers free business checking account with no minimum balance requirement.

- The user interface is intuitive and user-friendly, making it easy to manage finances.

- Novo integrates with popular accounting software like QuickBooks and Xero, streamlining bookkeeping.

Novo Conclusion

In conclusion, Novo is an online business banking solution that offers a range of services and features tailored to meet the needs of small businesses. By providing a user-friendly online platform and mobile app, Novo offers convenience and flexibility in managing business finances. Key benefits of using Novo include streamlined account setup, integrations with accounting software, expense tracking and reporting tools, instant money transfers, and transparent pricing. The platform also offers a business debit card and access to excellent customer support. Overall, Novo aims to provide a modern, efficient, and tailored banking experience for small businesses. For more specific information and to stay up to date with their services, I recommend visiting Novo’s official website or contacting their customer support.