Plus500 was established in 2008 and is the primary backer of football club Atlético Madrid. The Plus500 exchanging stage is presented by Plus500 UK Ltd which is approved and directed by the UK Financial Conduct Authority and is likewise an auxiliary of Plus500 Ltd which is a public corporation recorded on the London Stock Exchange.

The CFD agent’s exchanging stage is accessible for customers in excess of 50 nations and is approved and directed all throughout the planet by the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), the Monetary Authority of Singapore (MAS) and the Israel Securities Authority (ISA), among others.

Clients can exchange without commission with tight spreads on more than 2,500+ utilized agreements for distinction (CFD) instruments covering Forex, Commodities, Indices, Shares, Options and Cryptocurrencies* on the dealer’s own exclusive based exchanging stage which is highlight rich and incorporates progressed hazard the board devices, including ensured stop and following stop orders.

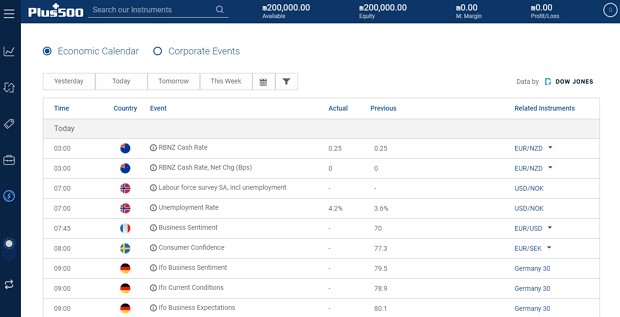

While the agent doesn’t give any market investigation or dealer instructive assets, they do have a monetary schedule inbuilt to the Plus500 exchanging stage and give some ‘how-to’ recordings in the Plus500 Trader’s Guide. Clients can likewise get to live client service in numerous dialects every minute of every day.

About Plus500

Established in 2008, Plus500 is public on the London Stock Exchange’s (LSE: PLUS) and is essential for the FTSE 250 Index. Plus500 serves online brokers through its managed auxiliaries that hold licenses in major monetary centers, including the United Kingdom,

Australia, New Zealand, Israel, and Singapore. In 2019, Plus500 adjusted more than 200,000 dynamic client accounts that opened 35 million positions, adding up to $1.31 trillion in exchanged worth. For additional on the organization.

Plus500 Pros and Cons

Plus500 has a basic, simple to-utilize site, with a particularly very much planned versatile stage. Furthermore, the record opening cycle and client care are extraordinary. During our record opening testing, our record was opened inside a day.

On the negative side, Plus500 has a restricted item portfolio, comprising just of CFD items. Some standard examination devices, similar to proposals and central information are not accessible. The CFD expenses are normal.

Pros

• Simple to-utilize stage

• Great record opening

• Quick and accommodating client assistance

Cons

• Restricted item range, just CFDs

• Mediocre exploration apparatuses

• Average CFD charges

Is Plus500 Safe?

Plus500 is viewed as generally safe, with a general trust score of 98 out of 99. Plus500 is public and doesn’t work a bank. Plus500 is approved by three level 1 controllers (high trust), four level 2 controllers (normal trust), and zero level 3 controllers (low trust). Plus500 is approved by the accompanying level 1 controllers: Financial Conduct Authority (FCA), Australian Securities and Investment Commission (ASIC), and the Monetary Authority of Singapore (MAS). Dive more deeply into Trust Score.

Platforms and Tools

The Plus500 web exchanging stage, WebTrader, is a great decision for easygoing financial backers because of its convenience and spotlight on giving simply the fundamental, essential apparatuses needed for exchanging.

Usability: For fresher brokers, the Plus500 WebTrader (program based) stage is an incredible spot to begin prior to graduating to a further developed stage. WebTrader is neatly planned and centers around straightforwardness. The couple of cutting edge highlights accessible inside Plus500’s leader stage incorporate following stops and ensured stop-misfortune orders (GSLO), which can be useful danger the board instruments for relaxed dealers.

Work area Stage: For work area, the Windows 10 form is as of now not accessible and didn’t work during our testing, even subsequent to refreshing the all around introduced work area programming. All things considered, the web adaptation meets the necessities of a dynamic web application and is installable as a Chrome application. This lets me know that the future for Plus500 is the internet browser over work area exchanging.

Outlining: Plus500‘s WebTrader stage gives appropriate diagramming, presenting more than 100 discretionary specialized markers close by the capacity to save graph layouts. Additionally, there are 21 attracting apparatuses the diagrams to support specialized examination.

MetaTrader, algo exchanging, duplicate exchanging: Because Plus500 offers a restrictive exchanging stage, MetaTrader isn’t advertised. Likewise, both algorithmic exchanging and social duplicate exchanging are not upheld at Plus500.

Security

The organization goes about as head and fences its openness with its parent organization to kill market hazard and to guarantee it isn’t presented to material misfortunes. While Plus500 doesn’t give extra store protection, it is enrolled with the important administrative specialists all through Europe and the Asia-Pacific locale:

Plus500 UK Ltd is approved and directed by the Financial Conduct Authority (FCA #509909). Office Address: Plus500UK Ltd, 78 Cornhill, London EC3V 3QQ

Plus500CY Ltd is approved and directed by the Cyprus Securities and Exchange Commission (License No. 250/14)

Plus500AU Pty Ltd holds AFSL #417727 gave by ASIC, FSP No. 486026 gave by the FMA in New Zealand and Authorized Financial Services Provider #47546 gave by the FSCA in South Africa

Plus500SEY Ltd is approved and directed by the Seychelles Financial Services Authority (License No. SD039)

Plus500SG Pte Ltd (UEN 201422211Z) holds a capital business sectors administrations permit from the Monetary Authority of Singapore for managing in capital business sectors items (License No. CMS100648-1)

As per the U.K. FCA’s customer cash rules, Plus500 is needed to find ways to guarantee customer reserves are not coexisted with corporate assets, in this manner protecting customer cash and resources if the organization becomes wiped out, by holding those assets in isolated records at controlled banks. On the off chance that Plus500 defaults, any deficit of assets up to £85,000 might be made up for under the Financial Services Compensation Scheme (FSCS).

Plus500 likewise offers negative equilibrium security, which is commanded under ESMA decides that came full circle in 2018, guaranteeing that customers can’t lose more than they have placed into their records. Ensured stop misfortune orders can be utilized on certain instruments relying upon economic situations yet they are dependent upon a more extensive spread.

Plus500 offers safety efforts, for example, bio-metric validation for its portable application and there is a clock that will log the client out of both the electronic and versatile applications in case they are not being utilized.

Research

Plus500 doesn’t offer any merchant research instruments or assets separated from an Economic Calendar which can be found on the site and in the exchanging stage, as displayed underneath:

Trading Platforms

Despite the fact that Plus500 utilizes a restrictive exchanging stage, the exchanging stage (Webtrader) can oblige the various requirements of the intermediary’s worldwide customer base, as it is accessible across a few unique renditions.

This Plus 500 survey incorporated different variants of the stages.

Retail and expert records work on a similar stage.

This makes advantages and disadvantages yet with cutting edge research devices close to the capacity to execute exchanges an easy to understand way the stage performs well.

The design is perfect and fresh, with clear ‘Purchase’ and ‘Short’ buttons, and basic put forth up of pause and line orders.

For the individuals who wish to exchange straightforwardly from the web, there is an electronic variant of the exchanging stage which can be gotten to with any internet browser. There is no mix with MT4 as of now.

Modern market data and news is accessible through the stage.

The critical contrast between the Webtrader exchanging stage and the stages given by different representatives in the business is the way that Plus500 exchanging stages work flawlessly with one another.

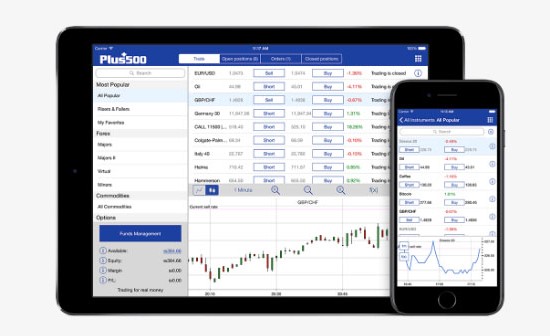

Plus500 Mobile Trading Platforms (illustrative costs).

Plus500 has additionally presented a bespoke CFD-managing stage, Plus500 Invest.

Customers can purchase, sell and hold in excess of 1,200 instruments, remembering stocks and ETFs for major worldwide trades in the US, UK and Germany. There are zero store and withdrawal expenses or guardianship accuses of the CFD stage.

The versatile CFD stage confesses all interface and with clear purchase and sell orders. Plus500 Invest is an extraordinary choice for fledglings new to the financial exchange and set up longer-term financial backers.

Mobile Trading

A versatile adaptation of the exchanging stage is likewise accessible to brokers who wish to exchange the business sectors utilizing only their cell phones or cell phones.

Given for nothing, the versatile exchanging application can be downloaded straightforwardly from Google Playstore or Apple App Store.

The versatile application is completely working, and offers all the exchanging choices that the online rendition does, remembering CFDs for stocks and offers. It is a solitary snap download, and exchanging through the application is speedy and simple.

Look and feel among versatile and online stages is kept something similar, making progress between the two extremely simple.

Both Android and iOS variants hold generally a similar low exchanging charges, spreads and rates and so on, and any exchanging portfolio is held across all stages.

Bonuses and Promotions

The Plus500 rewards and advancements rely upon the administrative ward. For instance, EEA-based dealers have none, as the European Securities and Markets Authority (ESMA), the super-controller of the EU, restricted them.

Dealers with the Seychelles or Singapore auxiliary get a first store reward on stores above $200. Agreements apply, and I suggest merchants peruse and comprehend them prior to mentioning a reward.

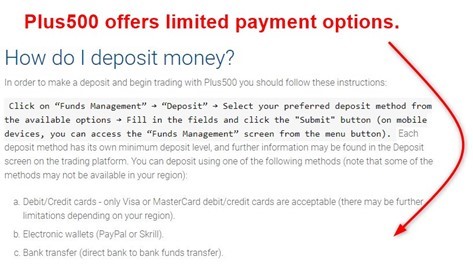

Deposits and Withdrawals

The exchanging stage handles every single monetary exchange, where the choices are restricted to five, and accessibility subject to geographic area. Plus500 doesn’t charge store or withdrawal costs however a cash transformations expense of 0.70% applies where fundamental. Outsider installment processor costs likewise exist, and I suggest brokers actually take a look at them. One more way of limiting expenses is to stay away from little or continuous withdrawals.

Plus500 notes inward handling times for withdrawals somewhere in the range of one and three work days. Outer handling times rely upon the ideal choice, yet the FAQ segment records extensive ones in any event, for expedient web-based administrations.

Customer Support

While the help administration at Plus500 is accessible day in and day out, it is just accessible through email or live visit. So despite the fact that their site is accessible in 32 unique dialects, there is no phone support.

Conclusion

Plus500 is a great internet based intermediary for cutting edge brokers hoping to exchange CFDs. It is controlled by level 1 specialists and recorded on a stock trade. Their expenses are on the low-end. The UI of its electronic and versatile stages are extraordinary. Least stores are low. Professional record give critical degrees of influence to Forex brokers.

It is among the best stages accessible. This article ought to give sufficient subtleties to you to realize what’s in store when you pursue their foundation.