What Is Borrowell ?

Borrowell is a Canadian financial technology company that provides online financial services to help individuals manage their credit and improve their financial well-being. The company offers a range of services, including free credit scores, credit monitoring, personalized recommendations, and access to loan and credit card offers.

Borrowell’s main objective is to empower individuals with tools and information to make informed financial decisions. By providing free credit scores and credit reports, users can understand their creditworthiness and track any changes in their credit profile over time. Borrowell also offers credit monitoring services to alert users of important changes, such as new inquiries or account openings, which helps detect and prevent potential identity theft or fraudulent activity.

One of Borrowell’s key features is its personalized recommendations. Based on users’ credit profile and financial goals, Borrowell provides tailored recommendations to help individuals improve their credit score and overall financial health. These recommendations may include tips for managing debt, suggestions for credit products, or financial products offered by Borrowell’s partners.

Additionally, Borrowell partners with various financial institutions to offer users access to loan and credit card offers. By leveraging users’ credit information, Borrowell matches them with potential lenders and financial products that align with their needs and credit profile.

How To Use Borrowell?

To use Borrowell, you can follow these steps:

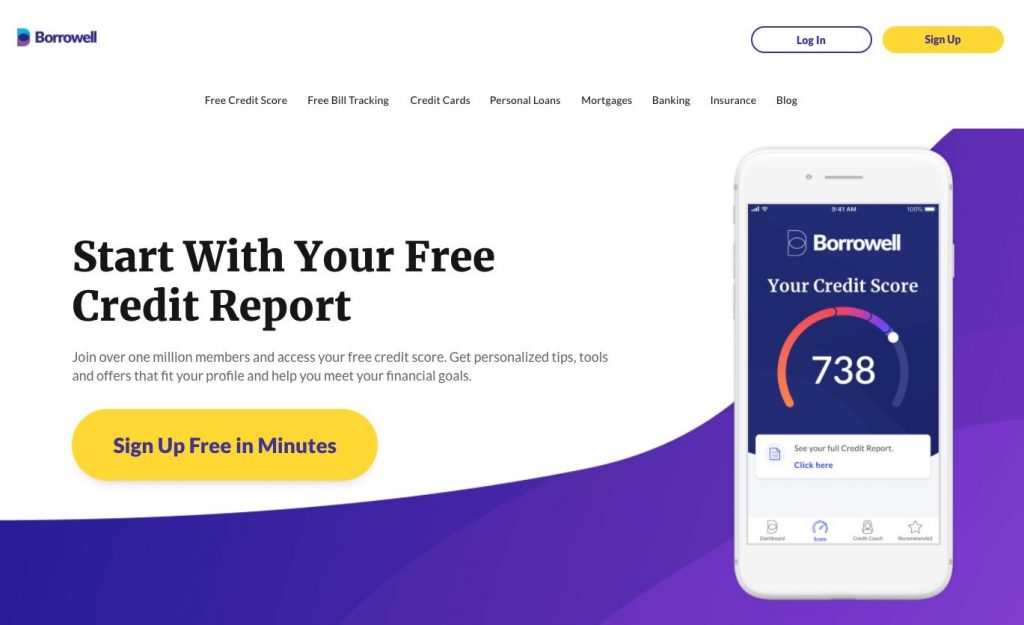

- Sign up for an account: Click on the “Sign up” or “Get my free credit score” button on the homepage. You will be prompted to create an account by providing some personal information, such as your name, email address, and password.

- Verify your identity: Borrowell will require you to verify your identity to ensure the security of your information. You may be asked to provide additional details, such as your address and social insurance number (SIN) or other identifying documents.

- Access your free credit score and report: Once your account is set up and verified, you can access your free credit score and credit report. Borrowell will provide you with your credit score and a detailed report that outlines your credit history, accounts, payment history, and other relevant information.

- Explore personalized recommendations: Borrowell will provide personalized recommendations based on your credit profile and financial goals. These recommendations may include tips for improving your credit score, managing debt, or suggestions for credit products that may be suitable for you.

- Monitor your credit: Borrowell offers credit monitoring services, so you can stay informed about any changes to your credit report. You will receive alerts for important updates, such as new inquiries or account openings, helping you detect and address potential identity theft or fraudulent activity.

- Utilize financial education resources: Borrowell offers educational resources and articles on credit, debt management, and personal finance. Take advantage of these resources to enhance your financial literacy and make informed financial decisions.

Borrowell Services

Borrowell offers a range of services to help individuals manage their credit and improve their financial well-being. Here are some of the key services provided by Borrowell:

- Free Credit Score and Report: Borrowell allows users to access their credit score and credit report for free. Users can view their credit score, understand the factors influencing their score, and track changes over time. The credit report provides a comprehensive overview of the user’s credit history, including accounts, payment history, and inquiries.

- Identity Theft Protection: Borrowell offers identity theft protection services to help users safeguard their personal and financial information. This service provides proactive monitoring, alerts, and assistance in case of suspected identity theft or fraudulent activity.

Benefits, Features And Advantages Of Borrowell

Borrowell offers several benefits, features, and advantages to users who utilize their services. Here are some of the key benefits of Borrowell:

- Credit Monitoring and Alerts: Borrowell’s credit monitoring service keeps users informed about important changes to their credit report, such as new inquiries, account openings, or changes in credit utilization. Users receive alerts, which can help them detect and prevent potential identity theft or fraudulent activity promptly.

- Personalized Recommendations: Borrowell offers personalized recommendations based on users’ credit profiles and financial goals. These recommendations provide valuable insights and suggestions on how to improve credit scores, manage debt, and make informed financial decisions. This personalized approach helps users address their specific financial needs.

- Loan and Credit Card Offers: Through partnerships with various financial institutions, Borrowell provides users with access to personalized loan and credit card offers. Users can compare and choose the best options that suit their needs, saving them time and effort in searching for suitable financial products.

- Financial Education Resources: Borrowell offers educational resources and articles on credit, debt management, and personal finance. These resources aim to enhance users’ financial literacy and empower them with the knowledge to make informed financial decisions.

- Identity Theft Protection: Borrowell provides identity theft protection services, which include proactive monitoring and alerts in case of suspected identity theft or fraudulent activity. This added layer of security helps users protect their personal and financial information.

- Convenience and Accessibility: Borrowell’s services are available online, making them easily accessible and convenient for users. Users can access their credit scores, reports, and recommendations anytime, anywhere, using their computer or mobile devices.

Overall, Borrowell’s services provide users with valuable insights, tools, and resources to manage their credit, improve their financial health, and make informed financial decisions.

Experts Of Borrowell

- Borrowell offers free credit score monitoring and financial advice to its users.

- The company provides personalized loan recommendations based on the user’s financial profile.

- Borrowell offers competitive interest rates for personal loans, which can help users save money in the long run.

- The company has a strong reputation for data security and privacy protection.

Borrowell Conclusion

In conclusion, Borrowell is a Canadian financial technology company that offers a range of services to help individuals manage their credit and improve their financial well-being. With Borrowell, users can access their free credit scores and reports, monitor their credit, receive personalized recommendations, and access loan and credit card offers.

Additionally, Borrowell provides educational resources and articles to enhance financial literacy and offers identity theft protection services to safeguard users’ personal and financial information.